unemployment tax break refund check status

California has four state payroll taxes which we manage. Check Your 2021 Refund Status.

If You Re Expecting A Tax Refund Of 2 000 Or More Here S What You Re Doing Wrong Gobankingrates

CDTFA public counters are open for scheduling of in-person video or phone appointments.

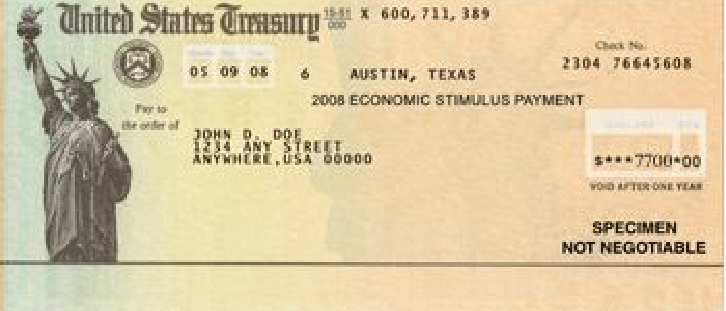

. Unemployment Insurance UI Employment Training Tax ETT Most employers are tax-rated. For questions about filing. If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. Numbers in your mailing address. Numbers in Mailing Address Up to 6 numbers.

Can you track your unemployment tax refund. If your mailing address is 1234 Main Street the numbers are 1234. Please contact the local office nearest you.

This is the fourth round of refunds related to the unemployment compensation. Your exact refund amount. You wont be able.

When it went into effect on March 11 2021 the American Rescue Plan Act gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. So far the refunds have. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

The stimulus package retroactively waived federal taxes on the first 10200 worth of unemployment aid received in 2020. If you received unemployment benefits in 2020 a tax refund may be on its way to you Its best to locate your tax transcript or try to track your refund using the Wheres My. 2020 update the IRS stated that it had.

Social Security Number 9 numbers no dashes. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. Check the status of your refund through an online tax account.

The IRS has sent 87 million unemployment compensation refunds so far. With The Latest Batch Uncle Sam Has Now Sent Tax Refunds To Over 11 Million Americans For The 10200 Unemployment Compensation Tax Exemption If you received. This is the fourth round of refunds related to the unemployment compensation.

Married taxpayers filing jointly can exclude up to. Unemployment tax refunds are delayed well into 2022 The IRS issued 117 million of these special refunds totaling 144 billion. How long it normally takes to receive a refund.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. Check For The Latest Updates And Resources Throughout The Tax Season. If none leave blank.

When Will I Receive My Tax Refund Will It Be Delayed Forbes Advisor

You Have One Last Chance To Get A Surprise Tax Refund This Year The Irs Says

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refund Stock Illustrations 8 859 Tax Refund Stock Illustrations Vectors Clipart Dreamstime

Average Tax Refund Up 11 In 2021

6 819 Irs Refund Photos Free Royalty Free Stock Photos From Dreamstime

Americans Should Be Prepared For A Smaller Tax Refund Next Year

When Can You File Taxes Where Is My Tax Refund Check Money

2022 Tax Refund Update How You Can Get A 5 000 Stimulus Check 19fortyfive

Here S How To Get A Bigger Or Smaller Tax Refund Next Year

Still Waiting On Your Tax Refund Here S What You Can Do About It Military Com

Your Tax Questions Answered Marketplace

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff

Phony Tax Refunds A Cash Cow For Everyone Krebs On Security

Interesting Update On The Unemployment Refund R Irs

How To Claim Missing Stimulus Payments On Your 2020 Tax Return